| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

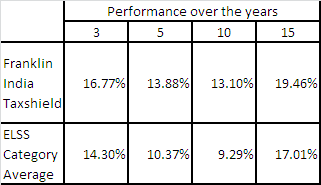

Franklin India Taxshield delivers by not losing ground when the market tanks.

If one looks at the returns over the past decade, it has been known to underperform the category average in good markets. On the flip side, it has fallen much below the category average during bear phases.

But, by and large, it is a steady performer. Its below-average performance is never abysmal and it manages to hold its own in a market carnage (see table below).

The portfolio is well diversified with around 60 stocks, the top 10 cornering around 38% of the portfolio with banks dominating (HDFC Bank, ICICI Bank, IndusInd Bank, Yes Bank, Axis Bank and Kotak Mahindra Bank). Currently the portfolio reveals a heavy bent towards large caps.

According to our fund analyst, fund manager Anand Radhakrishnan typically selects companies with robust business models, sustainable competitive strengths, and high corporate governance standards. Since the stocks meeting his criteria need not be cheap, Radhakrishnan will pay what he thinks is fair and has shown this in small/mid-caps, where he has displayed a willingness to pay more for incremental growth.

An astute stock picker, he tends to go against the tide. This may get reflected during periods when the market is galloping ahead and his returns are more subdued. But in the long run, his investors are a happy lot.

- Fund Manager: Anand Radhakrishnan

- Fund Category: Equity Linked Savings Scheme (equity tax planning)

- Portfolio: Large-cap with a bias for growth stocks

- Investment Process: A research-driven investment approach with a focus on reasonably valued quality stocks.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

0 comments:

Post a Comment