| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Section 80D tax benefit for multi-year Health Insurnace Plans

The Union Budget 2018-19 has made certain proposals that could benefit consumers of the health insurance industry, who prefer to pay insurance premiums for multiple years in one year itself.

The Budget 2018 speech, among the other changes proposed in direct taxes reads, "It is proposed to provide that in a case where premium for health insurance for multiple years has been paid in one year, the deduction shall be allowed proportionately over the years for which the benefit of health insurance is available." Let us try and understand the implications of what is said above.

Currently, under section 80D of the income-tax Act, a resident individual can claim a tax deduction of up to Rs25,000 in a year for the medical insurance premiums paid for self, spouse and children, and an additional Rs25,000 for premiums paid for parents.

If the parents are senior citizens and you are paying their medical insurance premiums, you can claim an additional deduction of up to Rs30,000—taking the total deduction to Rs55,000.

A deduction is the first tool to use to reduce your tax liability. It is a reduction from your total taxable income.

The Budget has also proposed to increase the section 80D deduction for senior citizens. Section 80D allows tax deduction for health insurance premiums paid. This has been proposed to be increased from up to Rs 30,000 to a maximum of Rs50,000 now.

So, if you are also paying the health insurance premiums for your senior citizen parents, your deduction limit under this section of the income-tax Act would go up to Rs75,000 from the Rs55,000 earlier.

The benefits proposed in section 80D are in addition to those proposed under section 80C, which can be availed up to a maximum of Rs 1.5 lakh. The 80C benefits cover premium paid for life insurance as well, apart from contributions to retirement investment avenues like the Employees' Provident Fund, National Pension System, Public Provident Fund and tax-saving mutual funds—also called equity-linked savings schemes.

Both the new proposals would take effect from 1 April 2019 and be applicable for assessment year 2019-20.

For someone who is in the highest tax bracket of 30%—the effective income tax rate for whom would now be 31.2%, given that the education cess has been increased to 4%—the tax savings would be up to Rs 15,600, compared to Rs 9,270 now. While this deduction has not been changed for taxpayers other than senior citizens, the proposal to get the claim proportionately in multiple years for single premium policies can be useful. For instance, if your health insurance premium for a sum assured for a family of four (husband, wife and two children) in one year is Rs20,000, you can claim this amount as a deduction under section 80D. However, insurance companies provide a discount if you take the policy for a period of 2 years, and your premium will be less than Rs 40,000 in that case.

Assuming that you get a 5% discount, you would pay Rs 38,000 for the 2-year cover. Under the current rules, you are only allowed to claim a deduction in the first year that too up to Rs25,000 only.

As per proposals in the 2018 Budget, you would be able to claim the total premium paid, proportionately, over the 2-year period, which would mean a deduction of Rs 19,000 in both the years.

However, you must note that in order to claim this tax deduction, you should not have paid the premiums in cash. The benefit is available if payment is made in any manner except in cash. You can pay using any online mode like internet banking, credit or debit cards, or can even pay by a cheque. Also, section 80D deduction benefits are not available to group health insurance premiums paid by your employers.

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

ICICI Prudential Dynamic fund is a Flexi Cap Value style fund managed by Sankaran Naren. The ability to think differently and pick stocks that have the potential to become a big thing tomorrow is critical in this strategy. When markets run up and valuations seem stretched, Naren reduces net equity exposure in the portfolio. He deploys a rules-based approach using the historical price/book value of the market to determine fair value and in turn tweak cash allocations. The portfolio has a large-cap bias with a value orientation and focuses on stocks that have significant long-term growth potential. His philosophy is to ensure the fund performs better than peers when markets fall, even if the strategy hurts performance in rising markets, thereby ensuring robust performance over a market cycle.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Invest Rs 1,50,000 and Save Tax up to Rs 46,350 under Section 80C. Get Great Returns by Investing in Best Performing ELSS Funds. Save Tax Get Rich

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Top 10 Tax Saving Mutual Funds of 2018

Best 10 ELSS Mutual Funds to Invest in India of 2018

1. Tata India Tax Savings Fund

2. Sundaram Diversified Equity Fund

3. DSP BlackRock Tax Saver Fund

4. Mirae Asset Tax Saver Fund

5. Birla Sun Life Tax Relief 96

6. ICICI Prudential Long Term Equity Fund

7. Invesco India Tax Plan

8. Reliance Tax Saver (ELSS) Fund

9. BNP Paribas Long Term Equity Fund

10. Axis Tax Saver Fund

Invest in Best Performing Tax Saver Mutual Funds of 2018

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Is your investment portfolio heavily tilted towards equities? Or are you a risk-averse investor choosing to put most of your money in fixed income? Or are you one of those who buy gold whenever you have investable surplus?

Building your investment portfolio is an ongoing process and concentration on any single asset class may not be the best investment strategy. For best returns and steady gains one needs to spread their investment over different asset classes to balance out risk related to specific assets at different investment cycles.

It is always good to be mindful of portfolio risk and that's where diversified portfolios come into picture. A diversified portfolio should have a blend of equity, commodity, fixed income, real estate and other alternative investment tools.

Investors to periodically rebalance their portfolio. If the time horizon for investment is long, market volatility should be either ignored or it should be leveraged to accumulate good quality stocks. Volatile markets are also periods where portfolios should be rebalanced to maintain the investment ratios of debt and equity among other assets. If a current investment portfolio does not have a fixed income component or the debt component is under represented it's always advisable to get some exposure. If the risk tolerance is low we would advise to get some exposure through balanced mutual funds which have both equity and debt component

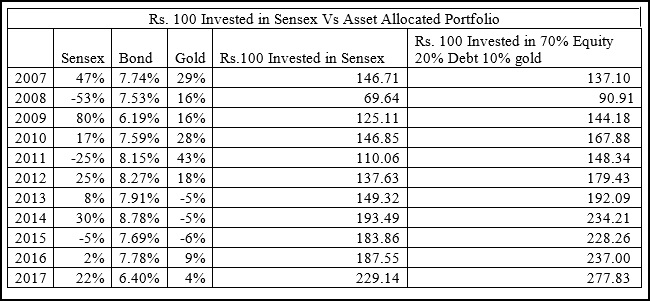

A portfolio which a carefully chosen asset mix stands to deliver better returns in the long term. Equity as an asset class delivers a CAGR 12-15% return over a long period. However, there is an element of risk associated with equity investments. On the other hand, gold as an asset class which could deliver a CAGR 8-10% over a long time. It is ideal to have an asset allocated portfolio which could deliver a better return

How investors can gain through proper asset allocation through a model portfolio:

The asset allocated portfolio has delivered 11% CAGR compared to Sensex CAGR of 8.6%. The chart shows clearly that an asset allocated portfolio has delivered a superior return than blind investment in Sensex

However, the chart is only for illustrative purpose and asset allocation would differ from individual to individual depending on factors such as risk-taking ability and age.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Edelweiss Dynamic Equity Advantage Fund (Edelweiss Absolute Return Fund)

| Investment Date | 1st April 2016 |

| Investment Amount | 100000 |

| NAV as on 1st April 2016 | 12.500 |

| Units purchased | 8000.000 |

| NAV as on 31st March 2017 | 12.91 |

| Investment Value as on 31st March 2017 | 103280 |

| % Return through Capital Appreciation (A) | 3.28 |

| Dividend Earned… |

|

| On 26th April 2016 @ 0.22/unit | 1760.00 |

| On 25th July 2016 @ 0.22/unit | 1760.00 |

| On 26th August 2016 @ 0.22/unit | 1760.00 |

| On 18th January 2017 @ 0.22/unit | 1760.00 |

| Total Dividend earned in FY 2016-17 | 7040.00 |

| % Return through Dividend Received (B) | 7.04 |

| % Total Return earned in FY 2016-17 (A+B) | 10.32 |

| Investment Date | 1st April 2016 |

| Investment Amount | 100000 |

| NAV as on 1st April 2016 | 18.14 |

| Units purchased | 5512.6792 |

| NAV as on 31st March 2017 | 20.11 |

| Investment Value as on 31st March 2017 | 110859.98 |

| % Total Return earned in FY 2016-17 | 10.86 |

Disclaimer: Past performance may or may not be sustained in the future.

Top 10 Tax Saver Mutual Funds for 2018

Best 10 ELSS Mutual Funds to invest in India for 2018

1. DSP BlackRock Tax Saver Fund

2. Invesco India Tax Plan

3. Tata India Tax Savings Fund

4. ICICI Prudential Long Term Equity Fund

5. Birla Sun Life Tax Relief 96

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2018 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Top 10 Tax Saver Mutual Funds for 2018

Best 10 ELSS Mutual Funds to invest in India for 2018

1. DSP BlackRock Tax Saver Fund

2. Invesco India Tax Plan

3. Tata India Tax Savings Fund

4. ICICI Prudential Long Term Equity Fund

5. Birla Sun Life Tax Relief 96

6. Franklin India TaxShield

7. Reliance Tax Saver (ELSS) Fund

8. BNP Paribas Long Term Equity Fund

9. Axis Tax Saver Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2017 Tax Saver Mutual Funds Online

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |