| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Aditya Birla Sun Life Equity Fund has a long history that spans nearly two decades. The fund was launched by Alliance Capital Mutual Fund in August 1998 as Alliance Equity Fund. It was the flagship diversified equity fund of the AMC at the time.

The fund gained popularity as it was managed by ace fund manager Mr Samir Arora, then CIO of Alliance Capital MF. He generated supernormal returns for the fund and other schemes of the fund house during the tech rally in 1999-2000. However, the overaggressive nature, also led to huge losses for investors when the tech bubble popped. Mr Arora had to quit the fund house in 2003, as the regulator had charged him of professional misconduct, fraudulent and unfair trade practices and insider trading.

A year later, Birla Sun Life Mutual Fund took over the assets of Alliance Capital Mutual Fund. Alliance Equity Fund was renamed to Birla Sun Life Equity Fund. And more recently, to Aditya Birla Sun Life Equity Fund, after 'Aditya' was prefixed to all legal entities of the Aditya Birla Group.

Through the long history of the fund, the fund management changed hands several times. Mr Mahesh Patil, presently co-CIO at ABSL Mutual Fund, was at the helm the longest – between November 2005 and September 2012. The fund is currently managed by Mr Anil Shah, who took over the reins in October 2012.

Though being free to invest in stocks across market-caps, ABSL Equity Fund maintains a large-cap bias. About 70%-75% of the assets are invested in large-cap stocks. Mid-and small-caps account for up to 20% of the portfolio. Thus the fund invests more like a large-cap fund, but maintains the flexibility to invest in mid caps if needed.

This flexibility enables the fund to provide stability in volatile market periods and turn aggressive when the market valuations come to be attractive.

In terms of performance, Aditya Birla SL Equity Fund has delivered a respectable performance over the long term, making it among the top performing funds for the period. However, its returns over the past year or so have trailed the benchmark. This can be attributed to the cautiousness developed due to the high market valuations. Hence, it needs to be seen how the fund is able to recover from here.

The fund gained popularity as it was managed by ace fund manager Mr Samir Arora, then CIO of Alliance Capital MF. He generated supernormal returns for the fund and other schemes of the fund house during the tech rally in 1999-2000. However, the overaggressive nature, also led to huge losses for investors when the tech bubble popped. Mr Arora had to quit the fund house in 2003, as the regulator had charged him of professional misconduct, fraudulent and unfair trade practices and insider trading.

A year later, Birla Sun Life Mutual Fund took over the assets of Alliance Capital Mutual Fund. Alliance Equity Fund was renamed to Birla Sun Life Equity Fund. And more recently, to Aditya Birla Sun Life Equity Fund, after 'Aditya' was prefixed to all legal entities of the Aditya Birla Group.

Through the long history of the fund, the fund management changed hands several times. Mr Mahesh Patil, presently co-CIO at ABSL Mutual Fund, was at the helm the longest – between November 2005 and September 2012. The fund is currently managed by Mr Anil Shah, who took over the reins in October 2012.

Though being free to invest in stocks across market-caps, ABSL Equity Fund maintains a large-cap bias. About 70%-75% of the assets are invested in large-cap stocks. Mid-and small-caps account for up to 20% of the portfolio. Thus the fund invests more like a large-cap fund, but maintains the flexibility to invest in mid caps if needed.

This flexibility enables the fund to provide stability in volatile market periods and turn aggressive when the market valuations come to be attractive.

In terms of performance, Aditya Birla SL Equity Fund has delivered a respectable performance over the long term, making it among the top performing funds for the period. However, its returns over the past year or so have trailed the benchmark. This can be attributed to the cautiousness developed due to the high market valuations. Hence, it needs to be seen how the fund is able to recover from here.

Investment Objective of Aditya Birla Sun Life Equity Fund

ABSL Equity Fund has an investment objective to generate "long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities."

Aditya Birla Sun Life Equity Fund Details

ABSL Equity Fund has an investment objective to generate "long term growth of capital, through a portfolio with a target allocation of 90% equity and 10% debt and money market securities."

Aditya Birla Sun Life Equity Fund Details

| Category | Equity Diversified | Style | Blend |

| Type | Open ended | Market Cap Bias | Multi Cap Fund |

| Launch Date | 14-Sep-98 | SI Return (CAGR) | 23.82% |

| Corpus (Cr) | Rs 9,376 | Min./Add. Inv. | Rs 500 / Rs 500 |

| Expense Ratio (Dir/Reg) | 1.03% / 2.26% | Exit Load | 1% |

Under normal circumstances, Aditya Birla Sun Life Equity Fund allocates –

Had you invested Rs 10,000 in Aditya Birla SL Equity Fund five years back on July 4, 2013, it would have grown to Rs 27,348 as on July 4, 2018. This translates in to a compounded annualised growth rate of 22.28%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – S&P BSE 200 - TRI index would now be worth Rs 21,254 (a CAGR of 16.27%). As can be seen in the chart alongside, the multi cap fund has generated a sustainable alpha over the benchmark. It has done well in the market rally that began in 2014, and has been able to maintain its lead. The fund is a promising contender in the amongst its peers.

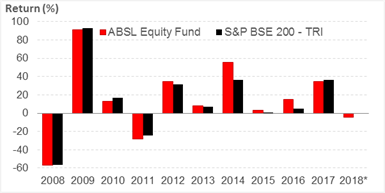

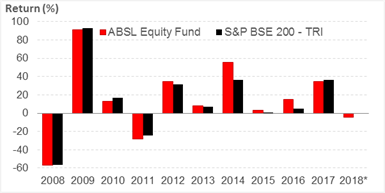

Aditya Birla Sun Life Equity Fund: Year-on-Year Performance

ABSL Equity Fund, is among the few schemes that have a track record of over two decades. The year-on-year performance comparison of the fund vis-à-vis its current benchmark – S&P BSE 200 -TRI Index shows that the fund has outperformed the benchmark in 6 out of last 10 calendar years. The fund went through a turbulent phase between CY2009 and CY2011, trailing the benchmark by 2-3 percentage points. However, the fund regained its foothold in the following years. Bulk of the alpha was generated in CY2014 to CY2016. The fund generated an excess return of 19 percentage points and 20 percentage points respectively over these periods. In CY2017 and year-to-date, the fund has seemingly run into a rough patch, trailing the benchmark.

- 80% - 100% to equity and equity related instruments

- 0% - 20% to debt and money market instruments

Had you invested Rs 10,000 in Aditya Birla SL Equity Fund five years back on July 4, 2013, it would have grown to Rs 27,348 as on July 4, 2018. This translates in to a compounded annualised growth rate of 22.28%. In comparison, a simultaneous investment of Rs 10,000 in its current benchmark – S&P BSE 200 - TRI index would now be worth Rs 21,254 (a CAGR of 16.27%). As can be seen in the chart alongside, the multi cap fund has generated a sustainable alpha over the benchmark. It has done well in the market rally that began in 2014, and has been able to maintain its lead. The fund is a promising contender in the amongst its peers.

Aditya Birla Sun Life Equity Fund: Year-on-Year Performance

ABSL Equity Fund, is among the few schemes that have a track record of over two decades. The year-on-year performance comparison of the fund vis-à-vis its current benchmark – S&P BSE 200 -TRI Index shows that the fund has outperformed the benchmark in 6 out of last 10 calendar years. The fund went through a turbulent phase between CY2009 and CY2011, trailing the benchmark by 2-3 percentage points. However, the fund regained its foothold in the following years. Bulk of the alpha was generated in CY2014 to CY2016. The fund generated an excess return of 19 percentage points and 20 percentage points respectively over these periods. In CY2017 and year-to-date, the fund has seemingly run into a rough patch, trailing the benchmark.

SIPs are Best Investments as Stock Market s are move up and down. Volatile is your best friend in making Money and creating enormous Wealth, If you have patience and long term Investing orientation. Invest in Best SIP Mutual Funds and get good returns over a period of time. Know which are the Top SIP Funds to Invest Save Tax Get Rich - Best ELSS Funds

For more information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

0 comments:

Post a Comment