| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Franklin India Prima - Invest Online

Come December, Franklin India Prima, one among the handful of funds to have been launched in the 90s, would complete two decades of investing in the Indian stock markets. While the fund ruled the mutual fund charts for many years (until the mid 2000s), it did see a fall from grace since and was languishing well after the 2008 market fall. But this mid-cap fund appears to be on a comeback trail, this time, seemingly less flashy and more resilient.

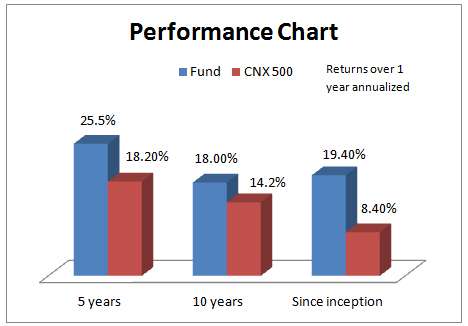

With a return of 25% compounded annually in the last 5 years, the fund trails top mid-cap peers such as IDFC Premier Equity and HDFC Mid-Cap Opportunities by just 1-2 percentage points. In the last 2 years, it actually improved, overtaking these peers by a good 3 percentage points.

Investors can use this mid-cap focused fund as a diversifier in their portfolio. The fund's current portfolio of stocks, given the exposure to many beaten sectors such as engineering, may provide sufficient returns when markets witness a more steady rally (unlike the short spurts seen now), backed by a revival in the economy. As such, our recommendation stems more on the prospects arising from the fund's current portfolio, rather than based on the last few years' performance.

Suitability

Franklin India Prima has done a good job of containing declines in the volatility of the past couple of years. Still, our belief about its comeback will be fully vindicated only if the fund outperforms in the next rally. Until then, use this fund as an add-on rather than for the core of your portfolio.

In terms of mid-cap holding, the portfolio's average market capitalization is higher than HDFC Mid-Cap Opportunities but lower than IDFC Premier Equity. That means its mid-cap exposure is higher than IDFC Premier Equity; the latter is known to hold a generous holding of large-cap stocks. Hence, its risk profile would also be higher than IDFC Premier Equity.

Performance

Franklin India Prima's performance had become lack-lustre by 2006; and in 2007, it severely underperformed peers and benchmark, refusing to take exposure to the then fancy sectors such as infrastructure and real estate. But underperformance continued even after the 2008 fall and the fund was losing assets as well.

But by 2011, the fund had found its feet, slowly accumulating a sound portfolio, as the 2011 market fall offered ample opportunities for stock picking. Its comeback performance in 2012, comfortably beating established peers, as well as beating the benchmark CNX 500 by a good 13 percentage points, helped it re-establish presence in the top quartile charts.

Interestingly, the fund's SIP return in the last 1 year, at 11.1%, is superior to peers. The CNX 500 delivered just 3.2% through an SIP, while the CNX Midcap index managed a negative -3.4%. The fund's SIP return (lump sum investment would have delivered 9%) is also evidence to the fact that SIPs are a better way to invest, especially in a volatile market.

Portfolio

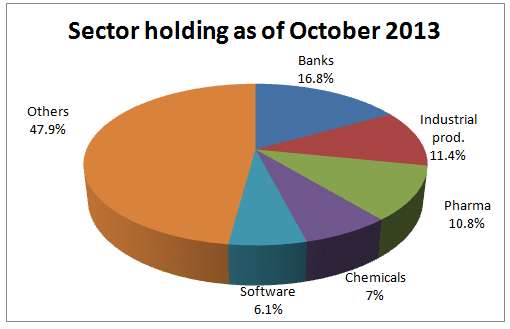

Franklin India Prima continues to place high weight on the banking and financial space, although pruning exposures compared with a year ago. Interestingly, it has cut back on exposure to pharma stocks over the last 1 year and instead, added industrial products and engineering stocks. Chemicals and fertilizer sector is among the top 5 sector choices, once again suggesting that the fund has offbeat choices.

At Rs 769 crore, the fund's asset size is compact for a mid-cap fund; providing enough room for maneuverability, especially in entering and exiting mid-cap stocks. Pidilite Industries, Amara Raja Batteries and Torrent Pharmaceuticals are among its top holdings. Finolex Cables, Thermax, Greaves Cotton and Gujarat Pipavav Port are some of its other stocks that may hold vast potential to gain with an economic upturn, given their beaten down status.

The fund is managed by K N Sivasubramanian and R Janakiraman.

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan

2.Reliance Tax Saver (ELSS) Fund

3.HDFC TaxSaver

4.DSP BlackRock Tax Saver Fund

5.Religare Tax Plan

6.Franklin India TaxShield

7.Canara Robeco Equity Tax Saver

8.IDFC Tax Advantage (ELSS) Fund

9.Axis Tax Saver Fund

10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online -

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

---------------------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

0 comments:

Post a Comment