| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Download Tax Saving Mutual Fund Application Forms

Invest In Tax Saving Mutual Funds Online

Leave a missed Call on

94 8300 8300

HSBC Mutual Fund has launched an open ended fund of fund called HSBC Managed Solutions Fund which will invest in existing schemes of HSBC MF – both domestic and international funds.

The NFO of the fund is currently open for subscription and closes on April 23, 2014.

The scheme aims to provide long term capital appreciation through an active asset allocation by investing in equity funds, debt funds, gold ETFs, offshore mutual funds and money market instruments.

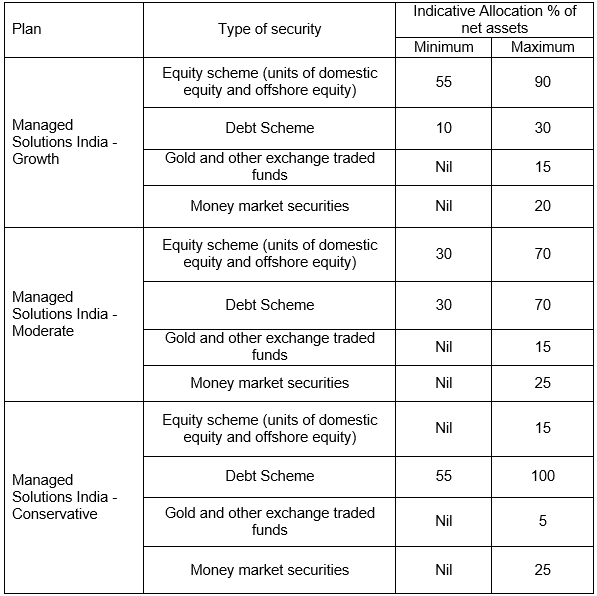

The fund is available in three options – growth, moderate and conservative based on risk profile of the investors. Growth option has more exposure to equity and the exposure comes down further in moderate and conservative plans. Also, growth option will be benchmarked against BSE 200 and Composite Bond Index while moderate and conservative options will be benchmarked against CRISIL Balanced Fund Index and CRISIL Composite Bond Index, respectively.

In a press release, the fund house says, "HSBC Managed Solutions is a holistic solution based on the principle of active Asset Allocation. Investments are managed dynamically across asset classes and rebalanced regularly to ensure optimal allocation for that risk profile."

Puneet Chaddha, Chief Executive Officer of HSBC Global Asset Management, India said, "There is a broad base of investors with varying risk profiles who require a simple, need-based solution which could stand as their core investment holding catering to their specific needs and risk profiles, and managed by a partner with expertise and experience they can trust. HSBC Managed Solutions allows people who do not have the time and expertise to manage their own portfolios to benefit from flexible asset allocation executed by our global award winning teams in a disciplined, risk-aware and cost effective approach, with the goal of capturing long-term growth."

Tushar Pradhan, Chief Investment Officer, HSBC Global Asset Management, India said, "Multi-asset is a successful and a core capability of HSBC Global Asset Management worldwide and this proposition fits perfectly in our endeavor to offer value propositions to our investors. This active asset allocation based solution helps contain portfolio volatility and positions it well to deliver better risk-adjusted returns over the long term. HSBC Managed Solutions builds in regular rebalancing as a core feature which helps the portfolio remain aligned to the needs of the investor."

The minimum investment amount of investment is Rs. 5,000. No exit load will be charged in the scheme. Sanjay Shah, Gaurav Mehrotra and Piyush Harlalka will co-manage the fund.

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

Leave a missed Call on 94 8300 8300

Leave your comment with mail ID and we will answer them

OR

You can write back to us at

PrajnaCapital [at] Gmail [dot] Com

---------------------------------------------

Invest Mutual Funds Online

Download Mutual Fund Application Forms from all AMCs

Download Mutual Any Fund Application Forms

---------------------------------------------

Best Performing Mutual Funds

- Largecap Funds Invest Online

- DSP BlackRock Top 100 Fund

- ICICI Prudential Focused Blue Chip Fund

- Franklin India Bluechip

- ICICI Prudential Top 100 Fund

B. Large and Midcap Funds Invest Online

- ICICI Prudential Dynamic Plan

- HDFC Top 200 Fund

- UTI Dividend Yield Fund

- Birla Sun Life Front Line Equity Fund

- Franklin India Prima

C. Mid and SmallCap Funds Invest Online

- Reliance Equity Opportunities Fund

- DSP BlackRock Small & Midcap Fund

- Sundaram Select Midcap

- IDFC Premier Equity Fund

- Birla Sun Life Dividend Yield Plus

- SBI Emerging Businesses Fund

- HDFC Mid-Cap Opportunities Fund

- ICICI Prudential Discovery Fund

D. Small and MicroCap Funds Invest Online

- DSP BlackRock MicroCap Fund

2.Franklin India Smaller Companies

E. Sector Funds Invest Online

- Reliance Banking Fund

- Reliance Banking Fund

- ICICI Prudential Banking and Financial Services Fund

F. Tax Saver Mutual Funds Invest Online

1. ICICI Prudential Tax Plan

2. HDFC Taxsaver

- DSP BlackRock Tax Saver Fund

- Reliance Tax Saver (ELSS) Fund

G. Gold Mutual Funds Invest Online

- Relaince Gold Savings Fund

- ICICI Prudential Regular Gold Savings Fund

- HDFC Gold Fund

- Birla Sun Life Gold

H. International funds Invest Online

1. Birla Sun Life International Equity Plan A

2. DSP BlackRock US Flexible Equity

3. FT India Feeder Franklin US Opportunities

4. ICICI Prudential US Bluechip Equity

5. Motilal Oswal MOSt Shares NASDAQ-100 ETF

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

0 comments:

Post a Comment