| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Best SIP Funds Online

Taking a loan, be it for a home or car, and the duration for which it should be taken, pose a dilemma for most investors. Some take a car loan for the maximum duration of seven years even though they can repay it earlier. Others take a big home loan for a shorter period of 7-10 years even if it strains their cash flow and doesn't leave any surplus to invest for other goals. "Repaying the loan should be top priority as peace of mind is very important. But first, you should decide on how big a house you need, the savings you have, and then pick the amount you take as loan

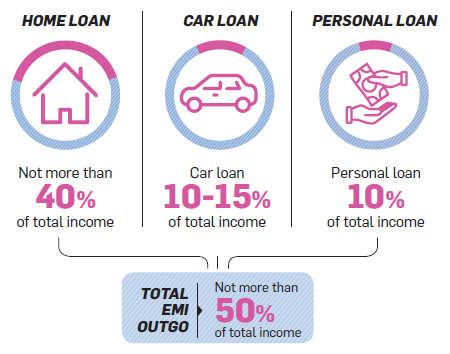

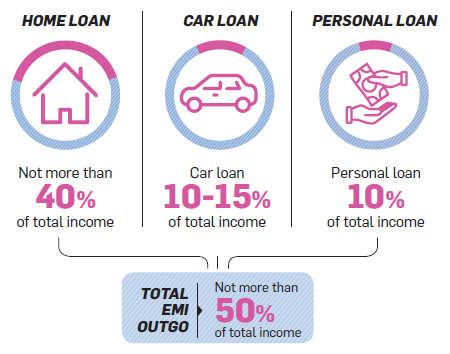

Income: If your cash flow doesn't allow you to pay a big EMI, you will have to take a smaller loan or for a longer duration. Remember that a home loan EMI should not exceed 40% of your total income.

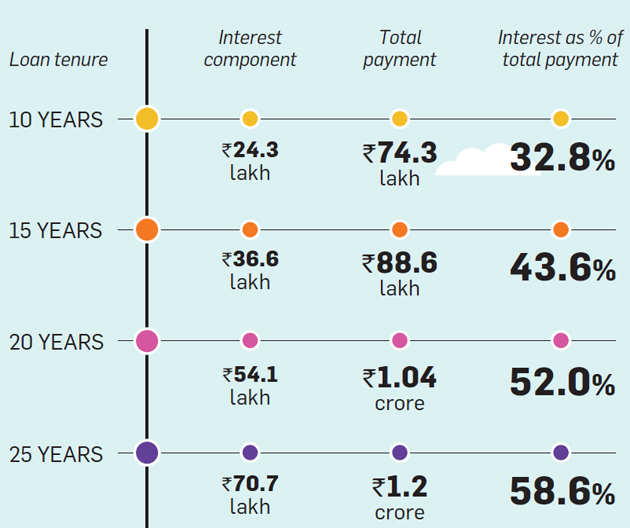

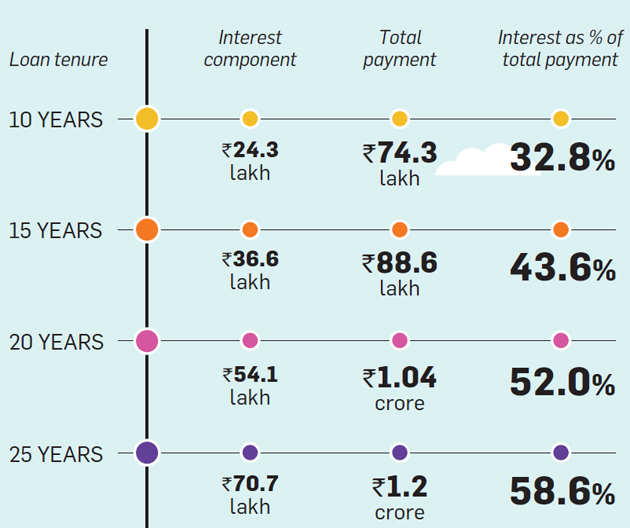

Tax benefit: While a home loan enjoys tax benefits, a car loan doesn't. A car is also a depreciating asset and it doesn't make sense to pay a high interest on it by taking a loan for a long duration. On the other hand, you get a Rs 2 lakh tax deduction on interest in the case of a home loan. This amount is unlimited if the house in question is rented. Interest rate: If you have a lump sum of Rs 10 lakh and can either invest it or buy a car, the decision should be taken on the basis of the rate offered on the loan. If the dealer gives you the loan at 7.5% and you can earn 12% on Rs 10 lakh, you should take the loan. It's also important to remember that the interest outgo keeps increasing with the tenure of the loan. So if you take a home loan for 25 years, you could end up paying over 50% of the loan as interest.

How much EMI should you pay?

You pay a higher interest for a longer loan tenure

If you took a home loan of Rs 50 lakh at 8.5% interest:

If you took a home loan of Rs 50 lakh at 8.5% interest:

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

0 comments:

Post a Comment