| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

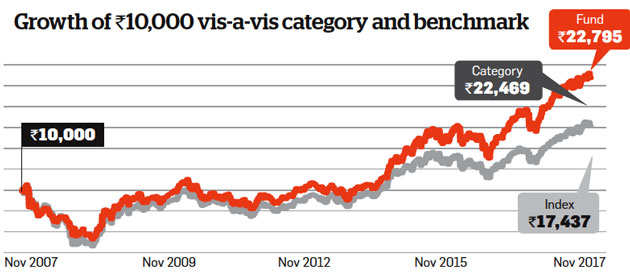

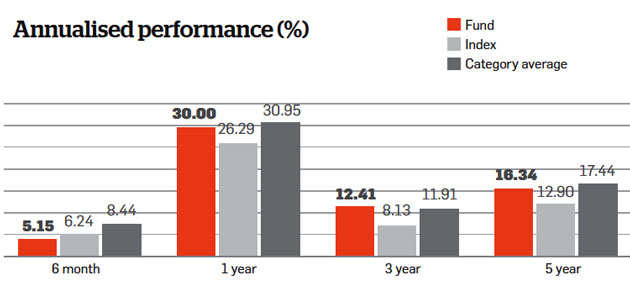

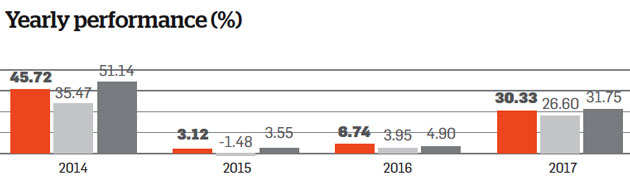

HDFC Midcap Opportunities - Mid Cap Equity Fund

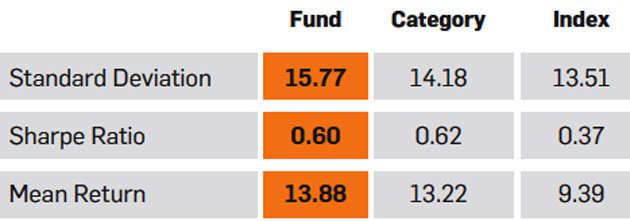

In our opinion, manager Chirag Staved ranks amongst the best portfolio managers in the small/mid-cap space. He has been managing this fund since its inception in June 2007. There is a perceptible quality bias in the investment style, characterized by investments in companies with strong management teams and robust business models. The manager is a patient investor with a long-term investment horizon, which jells well with the quality bias. Given the bias for quality stocks, we expect the fund to underperform the competition in market phases where momentum is in play, but does extremely well over the long term

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Buyers should remember that a bank's claim on a property put up for auction is restricted to the outstanding loans against it. Thus, the base price is determined by the outstanding amount.

The bank that auctions the property will cover all its dues, but there is no guarantee that the same property is not mortgaged with other lenders. This problem is more acute on land parcels than constructed residential flats or on commercial properties.

Though a bank will recover its dues fully from the bid amount, the bid winner has to bear all the related liabilities on that property like pending society dues, electricity bills, property tax, etc. Sometimes, these dues can be substantial, warns Kapoor of Liases Foras. This is because people default on housing loan EMIs last. There is high probability that the borrower might have defaulted on other expenses before that.

Generally, it is assumed that the property titles are clear because banks have already lent against it. However, this may not be true. With competition picking up, there are several instances of banks lending against properties with not so clear titles. For instance, for buildings that don't even have occupation certificates. Even if the banks might have taken full precaution at the time of giving loans, illegality might have happened later.

The chance of earlier owners staying in the house is less because banks usually ask them to vacate before auctioning the property. However, if it is already let out, the tenants may be still staying in the house and it becomes your responsibility to evict them. Freeing a house of its tenant is difficult in India, especially if the tenant has been staying there for long. The best strategy is to avoid a house which is already occupied

The existing owners will stop paying towards the upkeep of a property once they realise they are going to lose it. Even before the property is auctioned, the existing owners might stop maintening it due to financial stress. While this is not a very big issue, you do need to visit the house and also the locality to assess the situation.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Top 10 Tax Saving Mutual Funds of 2018

Best 10 ELSS Mutual Funds to Invest in India of 2018

1. Tata India Tax Savings Fund

2. Mirae Asset Tax Saver Fund

3. DSP BlackRock Tax Saver Fund

4. Sundaram Diversified Equity Fund

5. Birla Sun Life Tax Relief 96

6. ICICI Prudential Long Term Equity Fund

7. Invesco India Tax Plan

8. Reliance Tax Saver (ELSS) Fund

9. Axis Tax Saver Fund

10. BNP Paribas Long Term Equity Fund

Invest in Best Performing Tax Saver Mutual Funds of 2018

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

SIPs are Best Investments when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Jyoti Thakur (name changed) was shocked on being told that her claim to her late husband's life insurance policy had been rejected. The insurance company had, in a detailed letter, explained how her husband had failed to disclose necessary information while buying the insurance policy. This is not the first instance of claim rejection due to erroneous disclosure or hiding relevant information while taking a policy. In a recent report, the Insurance Regulatory and Development Authority of India (Irdai) had published data of claim settlement ratio submitted by various life insurers companies. The companies said most claims get repudiated due to non-disclosure of health conditions, misleading details of income and occupation and withholding of insurance with other companies prior to applying for the policy.

Correct details in proposal form

People insure themselves or their loved ones to ensure availability of adequate funds in case of sudden death of the insured having financial responsibilities. The provisions of insurance work like any other contract; albeit, it must be done in utmost good faith. For this, the insured person is required to disclose any potential matter that may influence the insurer's decision to accept the risk of loss.

The information submitted in the proposal form is the basis of contract between the insurance company and the insured, and it determines if the former is liable to pay the mutually consented amount to the nominee in case of death of the life insured. The amount of payment varies according to the terms stated in the contract and the premium paid (single payment or in instalments). Those seeking any kind of life insurance must ensure that they fill in accurate name (of both the insured and the nominees), correct mailing address and other contact details such as phone number and email id, pre-existing diseases, etc.

To avoid any possibility of dismissal of insurance claim, the insured must fill in correct details regarding:

Occupation and income: The maximum life cover allowed by any insurance company depends on the level of income, thus, necessitating the insured to provide right details of his/her income. Authenticity of income details may be determined by submission of last pay slip along with the Income Tax Return (ITR) filed. For those employed in risky occupations including aviation, army, police, defence services or mining jobs, giving information about the nature of job is especially important as the underwriting criteria decided by the insurer requires an added load to the premium paid.

Details of health: Insurance proposers tend to avoid filling details regarding health conditions fearing that information on any ailments may result in the insurer rejecting the contract or asking for a higher premium. It must be understood that insurance companies do not deny any scope for insurance to those afflicted with specific diseases or health troubles, but only after a proper and detailed medical examination along with extra premium.

History of illnesses in the family: Details of correct age along with health details of family members are important owing to the hereditary nature of certain diseases. Two or more people in the family succumbing to some specific illness that may be genetic in nature or exhibiting suicidal tendencies indicates a higher risk of death of those insured, and hence, attract higher premiums.

Taking a life insurance policy in the age of uncertainty is a way to show your loved ones that you care. Since the process involves underwriting a legal contract, it is necessary that extreme caution is taken while filling out the form. This will ensure timely and complete payment of the claim to the nominee.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

How about insuring your life. Most of us think, life insurance is for old age. But this is not the truth. All our life we constantly work hard to earn money for our family but the thought of securing their future with a plan comes seldom.

Although planning should begin with insurance, most of us do not realise the need for it. It's a stark reality but most of us buy insurance for tax planning only. The fact is that insurance is not for us, it's for our family.

Insurance pays in future by acting as a financial backup for the family's wellbeing when you are not around. Insurance gives the much needed financial support at the time of emotional disruption for someone losing his loved one.

Experts believe, equity market has the capability of giving double digit returns if held for more than 10 years.

While MF provide good returns, there is no life cover attached to it. On the other hand, in case of ULIPs either the higher of the cover amount or the fund value of the ULIP is paid out, or both the fund value and cover amount is paid out on death –depending on the type of ULIP chosen.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

With a 10-year return of 8.59%, the Sundaram Diversified Equity Fund mirrors the category average (8.43%), but has outperformed its benchmark index (5.72%). The fund's long-term performance is similar to the category average.

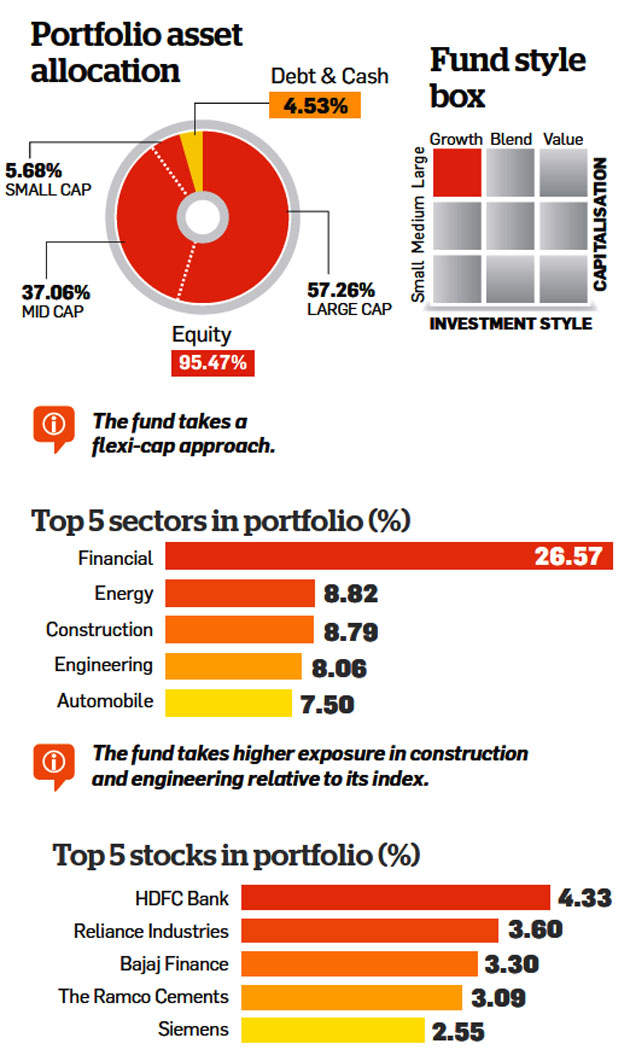

The current fund manager, who took over only a few years ago, has brought about a change in its investment approach. The portfolio construction is benchmark-agnostic, with modest exposure in individual bets, even as the portfolio has grown in size to around 70 stocks.

Currently, the fund has taken a higher exposure in construction and engineering sectors compared to its index. While the fund has improved its risk-return profile to some extent of late, it is yet to show

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

Top 10 Tax Saving Mutual Funds of 2018

Best 10 ELSS Mutual Funds to Invest in India of 2018

1. Tata India Tax Savings Fund

2. Sundaram Diversified Equity Fund

3. DSP BlackRock Tax Saver Fund

4. Mirae Asset Tax Saver Fund

5. Birla Sun Life Tax Relief 96

6. ICICI Prudential Long Term Equity Fund

7. Invesco India Tax Plan

8. Reliance Tax Saver (ELSS) Fund

9. BNP Paribas Long Term Equity Fund

10. Axis Tax Saver Fund

Invest in Best Performing Tax Saver Mutual Funds of 2018

Invest Best Tax Saver Mutual Funds Online

Download Top Tax Saver Mutual Funds Application Forms

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

Save Tax Get Rich Mutual Funds has employed the following parameters for shortlisting the mutual fund schemes.

1. Mean rolling returns : rolled daily for the last three years.

2. Consistency in the last three years : The three-year period is divided into smaller time periods each with a progressing weighting.

X = Returns below zero

Y = Sum of all squares of X

Z = Y/number of days taken for computing the ratio

Downside risk = Square root of Z

5. Asset size : For equity diversified funds, the threshold asset size is Rs 100 crore, and Rs 50 crore for balanced funds.

Invest Rs 1,50,000 and Save Tax up to Rs 46,350 under Section 80C. Get Great Returns by Investing in Best Performing ELSS Funds. Save Tax Get Rich

For further information contact SaveTaxGetRich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

OR

Call us on 94 8300 8300

A policy can be converted to a paid-up policy once it acquires a surrender value which is typically after 2-3 annual premiums are paid for traditional plans. For Ulips, there is a lock-in period of 5 years.

In case of a paid-up Ulip, the policy administration charges, mortality and fund management charges continue to be applicable and negatively impact the fund value.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |