| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Best Performing Equity Mutual Funds to Invest in India for 2016

Best Equity Mutual Funds - Invest Online

Equity funds give the highest returns by far and are usually categorized as high risk investments. Some of the best performing mutual funds in this class over the past 3 years have been:

Name | NAV* (Rs.) | AUM (Rs. Cr) | Expense Ratio (%) | Average Returns (3 years) (% p.a.) |

UTI Transportation and Logistics Fund | 86.72 | 591.39 | 2.78 | 43.34 |

ICICI Prudential Exports and Other Services Fund | 46.40 | 681.93 | 2.60 | 40.52 |

SBI Small & Midcap Fund | 30.47 | 492.97 | 2.47 | 38.90 |

Franklin India Smaller Companies Fund | 37.28 | 2448.89 | 2.35 | 37.39 |

*NAV rates as on 26th August 2015.

UTI Transportation and Logistics Fund: This is open-ended logistics sector based equity fund that aims to provide capital growth by investing in companies related to the fields of transportation manufacture, services, distribution, design or equipment sale. The fund has averaged returns to investors at the rate of 43.34% over the last 3 years, making it the best performing mutual fund in its category.

ICICI Prudential Exports and Other Services Fund: This is an open-ended services sector based equity fund which seeks to invest mainly in equity or related securities of firms involved in the services industry. The fund has provided returns at 40.52% p.a. over the last 3 years to investors.

SBI Small & Midcap Fund: This is an open-ended mid & small cap equity fund that is aims for long term wealth creation and capital appreciation through investments predominantly in equity and related securities of midcap and small firms. The fund has averaged returns of 38.90% p.a. in the last 3 years.

Franklin India Smaller Companies Fund: This is an open-ended mid and small cap equity mutual fund that seeks to offer long term capital growth through investments in small and midcap companies. In general, the fund has 3/4th of the portfolio made up of smaller companies. The fund has posted returns at 37.39% p.a. in the last 3 years.

Top 10 Tax Saving Mutual Funds to invest in India for 2016 or Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

Top 10 Tax Saver Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in India for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Religare Tax Plan

4. DSP BlackRock Tax Saver Fund

5. Franklin India TaxShield

6. ICICI Prudential Long Term Equity Fund

7. IDFC Tax Advantage (ELSS) Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

------------------------------

Top 10 Tax Saver Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Religare Tax Plan

4. DSP BlackRock Tax Saver Fund

5. Franklin India TaxShield

6. ICICI Prudential Long Term Equity Fund

7. IDFC Tax Advantage (ELSS) Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

Large Cap and Diversified Equity Mutual Fund SIPs Performance over last 15 years

Systematic Investment Plans (SIPs) were introduced in India almost 20 years back by Franklin Templeton. Since then, SIPs in good funds have generated excellent returns and created wealth for the investors. SIPs offer a simple and disciplined way to accumulate wealth over the long term. Mutual Fund SIPs work pretty much like bank recurring deposits, except they generate superior risk adjusted returns compared to recurring deposits. There are a number of benefits of retirement planning through Mutual funds Systematic Investment Plans (SIP):-

- The biggest advantage of SIPs is that, they make the need to time the market irrelevant. It is not possible to predict accurately how markets will behave. By investing at a regular frequency, e.g. monthly, one is invested both at the high and the low points of the market. SIPs work well in volatile markets, by averaging the cost of the investment.

- SIPs engender a disciplined approach to investing. By investing a fixed amount out of regular your savings, you will be able to build a corpus for your long term financial needs. Money not invested often gets spent on things that you may not need.

- Mutual Funds are very flexible instruments. There are no restrictions and penalties on regular SIP payments and withdrawals, unlike PPF or ULIPs. You can start a SIP with a monthly investment, as low as Rs 500. Some mutual funds have even lower minimum investment limit.

- For the smart investor, mutual funds offer more choices and transparency. You can select products based on your risk profile, track record, and fund objectives.

- Equity oriented mutual funds are more tax efficient than most other investment products. Long term capital gains for equity mutual funds are tax exempt. Most debt investments, with the exception of public provident fund, are taxable.

In this series of articles, we will look at how SIPs have created long term wealth for the investors in the last 15 years. In this article, we will discuss how SIPs in some large cap and diversified equity fund, have created wealth for their investors. For our discussion, we have selected 7 large cap and diversified equity funds that have given good returns in the last 15 years. This is, by no means, a comprehensive list of all the funds that gave good returns in the last 15 years. This just an illustration of how long term investments in SIPs, have created wealth for investors. Each of the funds in our selection has given SIP returns of nearly 20% annualized. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

For our examples, we have assumed a monthly SIP of Rs 3000 only, made on first working day of every month in the funds that we will discuss. Let us assume the SIP start date was 15 years back in May 1999. Over this period, the investor would have invested Rs 5.43 lakhs in SIPs of the following mutual funds. Let us see how much wealth would they have accumulated, by investing in the following funds.

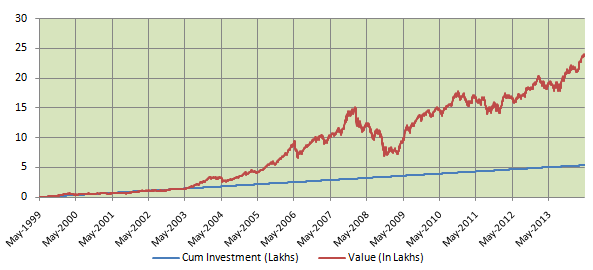

ICICI Prudential Top 100 Fund:

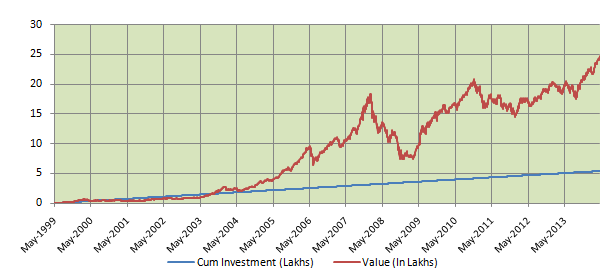

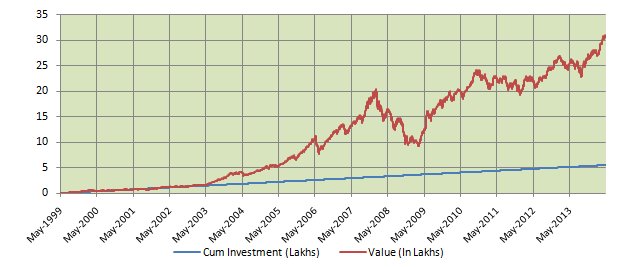

Within the ICICI Prudential stable, ICICI Prudential Dynamic Plan gave the highest annualized returns among all large cap and diversified equity funds in the last 10 years. But this fund has not yet completed 15 years, and so we were not able to select this fund. However, the ICICI Prudential Top 100 fund, a large cap fund launched in 1998, has also given excellent returns over the last 15 year period. The fund has an AUM base of nearly Rs 450 crores and is managed by Sankaran Naren. The chart below shows the SIP returns of the ICICI Prudential Top 100 fund, growth option, over the last 15 years.SBI Magnum Multiplier Plus Fund:

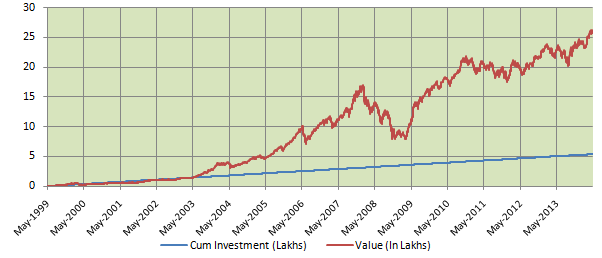

The SBI Magnum Multiplier Plus, a diversified equity fund was launched in 1993. The fund has an AUM base of over Rs 1000 crores and is managed by Jayesh Shroff. The chart below shows the SIP returns of the SBI Magnum Multiplier Plus fund, growth option, over the last 15 years.Franklin India Bluechip Fund:

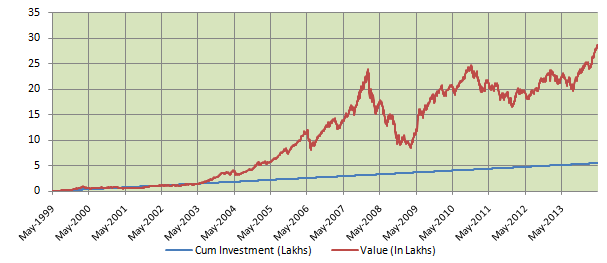

The Franklin India Bluechip fund, a large cap fund launched in 1993, has for long been a favourite with investors. The fund, proclaimed by many financial planning experts as one of the best ever mutual funds, its current relative under performance notwithstanding, has an AUM base of nearly Rs 4000 crores and is managed by Anand Radhakrishnan. The chart below shows the SIP returns of the Franklin India Bluechip fund, growth option, over the last 15 years.Birla Sun Life Equity Fund:

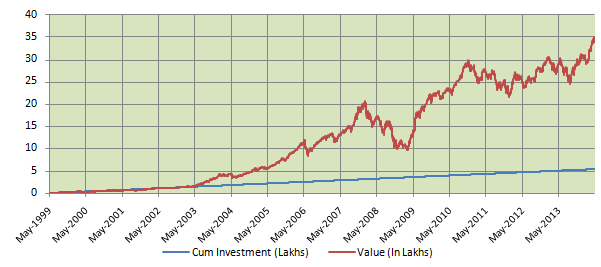

The Birla Sun Life Equity fund is a diversified equity fund launched in 1998. This fund from the Birla Sun Life stable has an AUM base of nearly Rs 650 crores and is managed by Anil Shah. The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, up one place from the ranking for the quarter ending December 31, 2013. The chart below shows the SIP returns of the Birla Sun Life Equity fund, growth option, over the last 15 years.Franklin India Prima Plus:

The Franklin India Prima Plus fund is a diversified equity fund launched in 1994. This fund from the Franklin Templeton stable has an AUM base of nearly Rs 1990 crores and is managed by R.Janakiraman and Anand Radhakrishnan. The chart below shows the SIP returns of the Franklin India Prima Plus fund, growth option, over the last 15 years.HDFC Top 200 Fund:

The HDFC top 200 fund, a large cap fund launched in 1996, has for long been a favourite with investors. This fund from India's largest AMC, has often been proclaimed by many financial planning experts as one of the best ever mutual funds, its current relative under performance notwithstanding. The fund has an AUM base of over Rs 10,000 crores and is managed by Prashant Jain. The chart below shows the SIP returns of the HDFC top 200 fund, growth option, over the last 15 years.HDFC Equity Fund:

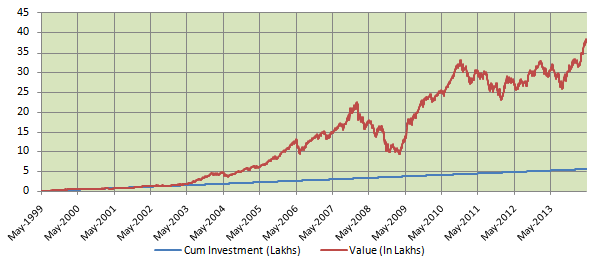

The HDFC Equity fund is a diversified equity fund launched in 1994. This fund from India's largest AMC has an AUM base of nearly Rs 10000 crores and is managed by Prashant Jain. The chart below shows the SIP returns of the HDFC Equity fund, growth option, over the last 15 years.

If you had started a monthly SIP of Rs 3000 in ICICI Prudential Top 100 fund back in May 1999, by now you would have accumulated nearly Rs 24 lakhs corpus, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs by the end of 2012. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 17.8%.

If you had started a monthly SIP of Rs 3000 only in SBI Magnum Multiplier Plus fund back in May 1999, by now you would have accumulated a corpus of over Rs 24 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of Rs 15 lakhs by the end of 2007 and a corpus of Rs 20 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 18.1%.

If you had started a monthly SIP of Rs 3000 only in Franklin India Bluechip fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 26 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 18.7%.

If you had started a monthly SIP of Rs 3000 only in the Birla Sun Life Equity fund back in May 1999, by now you would have accumulated a corpus of over Rs 28 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs around the end of 2009. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 20%.

If you had started a monthly SIP of Rs 3000 only in the Franklin India Prima Plus fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 31 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs around the end of 2009. Your corpus would have crossed the Rs 25 lakhs mark by the end of 2012. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 21%.

If you had started a monthly SIP of Rs 3000 only in the HDFC top 200 fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 35 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of nearly Rs 20 lakhs by the end of 2007. Despite the severe financial crisis, your corpus would have crossed the Rs 30 lakh mark by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 22%.

If you had started a monthly SIP of Rs 3000 only in the HDFC Equity fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 38 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of nearly Rs 10 lakhs by the end of 2005, a corpus of nearly Rs 15 lakhs by the end of 2006 and a corpus of Rs 20 lakhs by the end of 2007. Despite the severe financial crisis, your corpus would have hit the Rs 25 lakhs mark by the end of 2009 and crossed Rs 30 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 23%.

Conclusion

In this article, we have seen how SIPs in large cap and diversified equity funds over the long term have created wealth for the investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIP, the greater is the potential for wealth creation. However, it is important to select a good fund for our SIPs. Your financial advisers can help you select a good fund that is suitable for your risk profile. As your risk profile changes over time, you should re-balance your portfolio to align with your risk profile. Tomorrow, we will discuss how SIPs in small and midcap funds have created wealth for the investors.

Top 10 Tax Saving Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Franklin India TaxShield

4. ICICI Prudential Long Term Equity Fund

5. IDFC Tax Advantage (ELSS) Fund

6. Birla Sun Life Tax Relief 96

7. DSP BlackRock Tax Saver Fund

8. Reliance Tax Saver (ELSS) Fund

9. Religare Tax Plan

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

You can open the electronic account by directly approaching the repository, or through your insurer, who can do it through its partnership with a repository. There is no extra cost involved in opening the electronic account. After you get an account, all your insurance policies will be available at one place. You can access them at any time and when it comes to making a claim or registering a complaint, you will not need to pay a physi cal visit to the insurance office or branches. The complaint will be addressed by policyholders' grievance cell set up in the repository. Besides, the system ensures complete data confidentiality.

A big advantage for the industry is that the introduction of KYC will result in the creation of a reliable and comprehensive data base, complete with the insurance history of the customer and his insured assets, along with claim details.

HOW TO OPEN AN ACCOUNT

The first step is choosing an insurance repository and you can pick one from the five authorised by IRDAI: CAMS Repository Services, Karvy Insurance Repository, Central Insurance Repository, NSDL Database Management and SHCIL Projects.

The next step is to log in to the website of the repository insurance company and fill up the ap plication form. Attach the KYC documents with the form and submit these online. The documents mandatory for opening the account are Aadhar card or Permanent Account Number (PAN) card. There are other documents that you can submit as address proof, including the registered lease and licence agreement agreement for sale, Aadhar letter, ration card, driving licence, etc. You could visit the insurer's or repository's website for easy reference to the documents required to be submitted for proof of date of birth or for more information on KYC documents.

You can also submit the documents to an `Approved Person', which is a Point of Sale (PoS) entity appointed by the repository to extend its services. The repository then verifies the documents and feeds the data in the system to open an electronic account. An e-insurance account will be opened within seven days of the date of submission of completed application form. Once the account is opened, a welcome kit, containing the login ID and password, is mailed to you. Now you can log in to the repository website and use the account.

HOW TO BUY AN E-INSURANCE POLICY

If you have opened your e-insurance account through the website of the authorised insurance repository, you will have to share the e-account number with the insurance company while buying the policy online or in person. The repositories are not authorised to sell policies to customers and can only maintain policies in the electronic form, besides providing the details.

If you have opened the account through the insurance company, you need not worry as the processing and all other activities related to the purchase will be completed by the insurer.

Once the account is opened, you can pay the premium by logging into your account. Electronic payments are becoming increasingly popular due to the widespread use of online shopping and banking. The bigger advantage is instant gratification of policy issuance that enables customers to transact 24x7. This will help pay the premiums under one roof, instead of logging in individually to different insurer websites that you may have opted for.

CONVERTING PHYSICAL POLICY TO E-POLICY

These rules apply only for new policies and the existing policies can continue to be held in the physical form. However, if you want to convert your physical policies, you can forward the request by filling the necessary form. You can either log in to the repository website or inform the insurer to convert the policy and link it to your e-insurance account. The e-insurance account is a new paradigm, which will come with a lot of attendant benefits for both the insurers and customers. Policies will be issued instantly and directly to the customer in the digital form and, hence, the question of delay in issuance or non-receipt of policy will not arise.

------------------------------

Top 10 Tax Saver Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in India for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Religare Tax Plan

4. DSP BlackRock Tax Saver Fund

5. Franklin India TaxShield

6. ICICI Prudential Long Term Equity Fund

7. IDFC Tax Advantage (ELSS) Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

A joint savings account comes with operating options such as either or survivor, anyone or survivor, former or survivor and latter or survivor

Different types of joint accounts

A joint savings account comes with operating options such as either or survivor, anyone or survivor, former or survivor and latter or survivor. These terms decide how you can operate the account and what happens to the money in case of death of an account holder.

Either or survivor: If you select this option, then either of the account holders can operate the account. For instance, if a brother and sister hold an either or survivor joint account, both can operate it.

Former or survivor: If you have picked this option, only the first account holder will be able to operate the account. For example, if a husband and wife have a joint account, and the wife is the first account holder, only she will be able to operate it.

Latter or survivor: In this option, only the second account holder can operate the account. Say, in the above example, the couple opts for the latter or survivor option. Then the husband, who is the second account holder, will be able to operate the account, and not the wife.

If there are multiple account holders, then banks offer another option-anyone or survivor. Here, all account holders can operate the account.

Things to remember

What happens to the money when an account holder dies? According an RBI notification, in case of death of one of the joint account holders, the survivor will hold the money only as a trustee of the legal heirs unless she herself is the legal heir. "Even though payment to the survivor will confer a valid discharge to the bank, the survivor will, however, hold the money only as trustee for the legal heirs (who may include the survivor as well) unless she is the sole beneficial owner of the balance in the account or the sole legal heir of the deceased," it said.

In case the legal heir of the deceased lays a claim to the amount in the account, the survivor is the person to whom the bank makes the payment. So unless the bank is restrained by an order of a court, it can make the payment to the survivors named in the account. In case of joint accounts where the terms do not indicate that the amount due should go to the survivor, in such a situation the money will go to the survivor and legal heirs of the deceased joint account holder.

------------------------------

Top 10 Tax Saver Mutual Funds to invest in India for 2016

Best 10 ELSS Mutual Funds in India for 2016

1. BNP Paribas Long Term Equity Fund

2. Axis Tax Saver Fund

3. Religare Tax Plan

4. DSP BlackRock Tax Saver Fund

5. Franklin India TaxShield

6. ICICI Prudential Long Term Equity Fund

7. IDFC Tax Advantage (ELSS) Fund

8. Birla Sun Life Tax Relief 96

9. Reliance Tax Saver (ELSS) Fund

10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online

For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call

------------------------------

Leave your comment with mail ID and we will answer them

OR

You can write to us at

PrajnaCapital [at] Gmail [dot] Com

OR

Leave a missed Call on 94 8300 8300

------------------------------

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |

Popular Posts

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 83...

-

Invest Birla Sun Life Debt Funds Online Scheme The Average Maturity Of Complete Portfolio YTM Mark to Mkt Modified ...

-

Bajaj Allianz Life has launched Young Assure, a non-linked, participating plan to help people fund their children's education....

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Call 0 94 8300 83...

-

Birla Sun Life Mutual Fund has announced dividend under the dividend option of Birla Sun Life MNC Fund. The quantum of dividend shall b...

-

Invest Mutual Funds Online Download Mutual Fund Application Forms Buy Gold Mutual Funds Gold Savings Funds An int...

-

Top SIP Funds Online The government of India has paved the way for the launch of India's first corporate bond ETF called as Bharat B...

-

Buy Gold Mutual Funds Invest Mutual Funds Online Download Mutual Fund Application Forms Call 0 94 8300 8300...

-

Invest In Tax Saving Mutual Funds Online Download Tax Saving Mutual Fund Application Forms Buy Gold Mutual Funds Ca...

-

Top SIP Funds Online Mirae Asset Focused Fund (MAFF ) is a new fund from the stable of Mirae Asset Mutual Fund. It is an open-ended ...

| Mutual Fund Application Forms | Download Any Applications |

| Invest in Tax Saving Mutual Funds | Invest Online |

| Infrastructure Bond Application Forms | Download Applications |